ESG Core Equity*

Invests across the range of market capitalizations and economic sectors in companies that meet Trillium’s sustainability criteria.

Invests across the range of market capitalizations and economic sectors in companies that meet Trillium’s sustainability criteria.

Investment Process

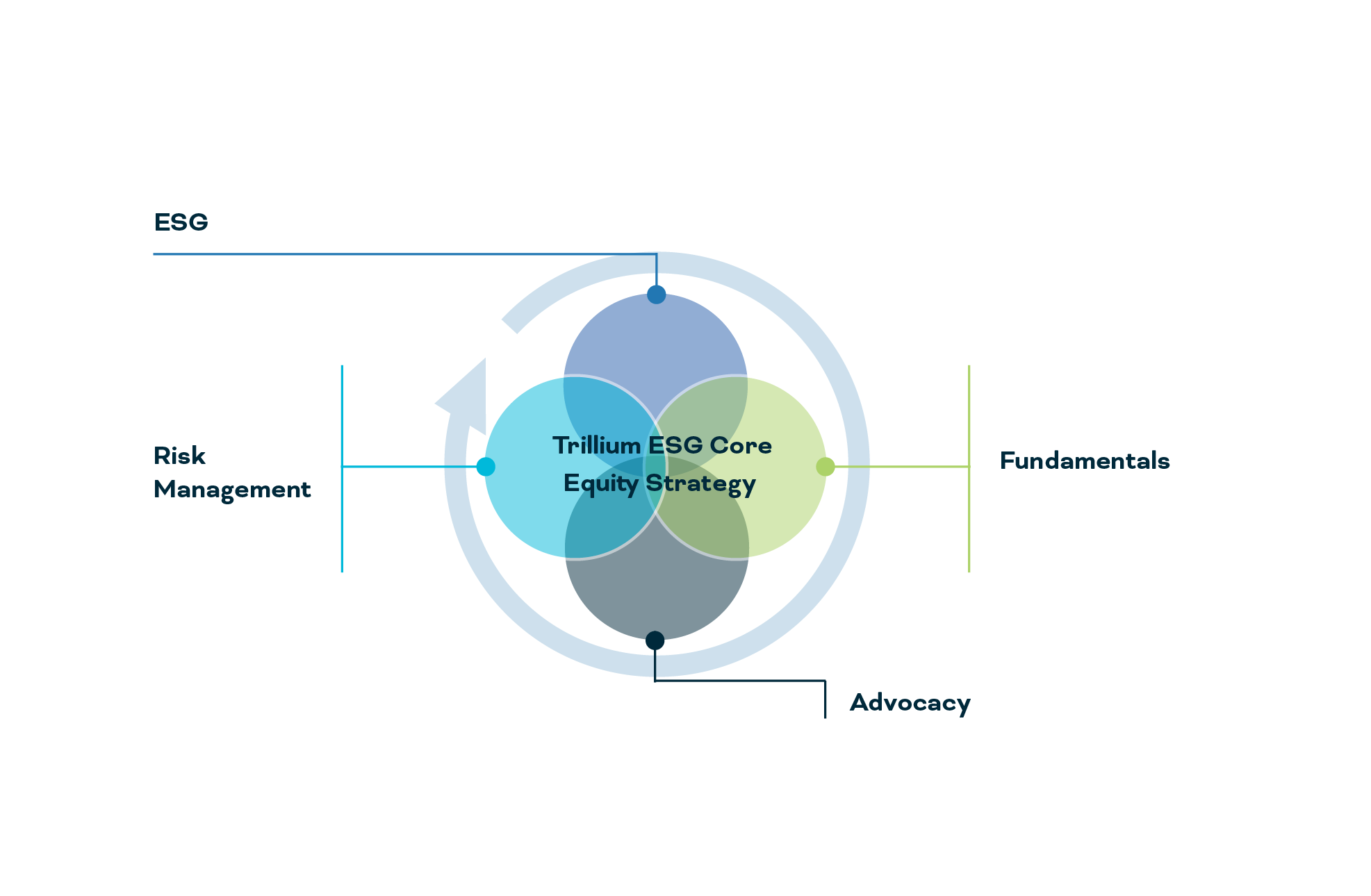

Fundamental equity analysts, who divide coverage by sector, are responsible for providing in-depth analysis of companies and generating new buy ideas consistent with the strategy’s high quality approach, including a rigorous integrated review of financial and ESG factors. The Investment Management Committee, comprised of portfolio managers and analysts, meets periodically to review and approve recommendations to the buy-list recommended by the analysts. A strategy team, headed by the lead Portfolio Manager, rebalances the portfolio on at least a quarterly basis to identify the best subset of names from the buy-list at that particular point of time. The team leverages an optimization process that helps monitor and control portfolio characteristic exposures while overweighting companies based on a proprietary alpha score that includes an analyst rating. In this sense, the strategy is fundamentally driven, but quantitatively assisted.

Contact Information

Portfolio Managers

** Traditional separately managed accounts as well as model delivery through intermediary partnerships.

(weighted avg. billions)

(1/1/2007)